Hedge Fund Risk Analysis

Hedge Fund Risk Analysis Table

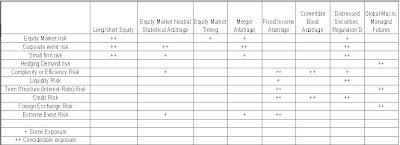

When discussing risk management in the hedge fund industry, obtaining a clear definition of the different types of risk exposure for each kind of hedge fund is important. Considering the wide range of objectives and diverse trading instruments used by each specific type of hedge fund, it is important to note the varying risk concerns which apply to different types of hedge fund managers.

When discussing risk management in the hedge fund industry, obtaining a clear definition of the different types of risk exposure for each kind of hedge fund is important. Considering the wide range of objectives and diverse trading instruments used by each specific type of hedge fund, it is important to note the varying risk concerns which apply to different types of hedge fund managers.

A good consolidation of the results in a matrix form was developed by Jaeger and Säfvenblad , who define the different risk exposures by each type of hedge fund as follows (click to enlarge the image below):

Using the table above, but now with a investor’s perspective, it should be also clear that the risks associated to investing in a long-short hedge fund are completely different from those associated to, for instance, investing in a Fixed-Income Arbitrage hedge fund. Thereby, for both hedge fund managers and investors, uncovering the different dimensions of risk present in each hedge fund portfolio becomes the first step towards managing risk effectively.

Read more articles like this within the Hedge Fund Due Diligence Guide.

- Richard

Subscribe To this Blog via Email Or RSS

Articles Related to Hedge Fund Risk Analysis

1. Hedge Fund Risk Video

2. Asset Allocation Diversification

3. High Net Worth Investors

4. Hedge Fund Due Diligence Guide

5. Hedge Fund Terms

6. Pension Fund Investment

7. Hedge Fund Databases

8. Chartered Financial Analyst CFA

9. Chartered Alternative Investment Analyst (CAIA)

10. Hedge Funds Risk Management

Permanent Link: Hedge Fund Risk Analysis

Tags: Hedge Fund Risk Analysis, Hedge Fund Risk Analyses, Hedge Funds Risk Analysis, Hedge Fund Risk Management, Hedge Fund Risk Assessment, Hedge Fund Risk Manager, Hedge Fund Risks, Hedge Fund Risk Analyst, Hedge Funds Risk