Flash Crash Lawsuit

Dallas Hedge Fund Sues Over Losses During Flash Crash

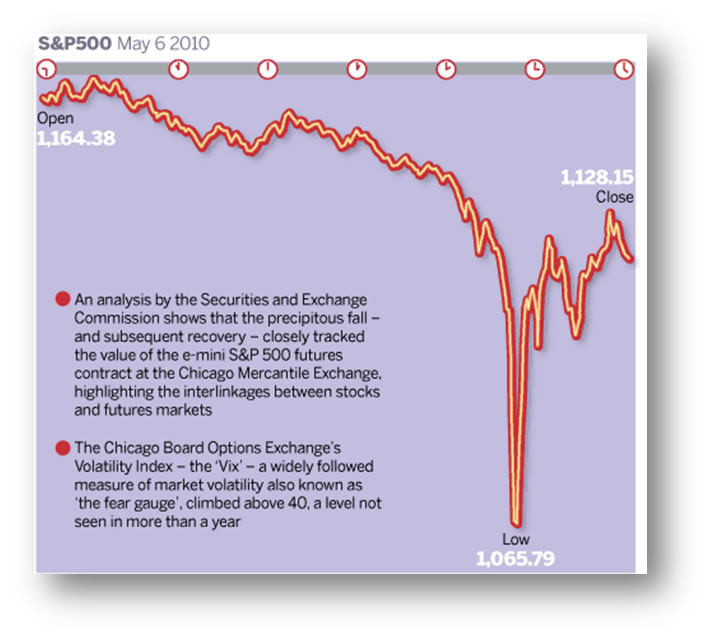

A small-size hedge fund based in Dallas is suing three Chicago financial trading firms including Citadel hedge fund firm. The lawsuit brought by NorCap involves the "flash crash" that occurred earlier this year and the losses incurred by Norcap's GovPlus Master Fund LP and GovPlus Fund AI LP funds. The suit claims that the Chicago firms should pay back GovPlus's losses off put options that day because the losses were allegedly a result of a computer glitch.

The prices the GovPlus funds paid were probably based on "some form of computer glitch" that led to erroneous prices, the lawsuit said. The suit was filed this week in state court in Illinois against Citadel, Wolverine Trading LLC and Chicago Trading Co.

"Under Illinois law, where a plaintiff has conferred a benefit upon a defendant, and the defendant's retention of that benefit would violate equity and good conscience, the defendant must return the benefit," the lawsuit said, accusing the defendants of "unjust enrichment."

Representatives of Citadel and Wolverine said their firms had no comment on the lawsuit. A representative of CTC could not be reached.

Before markets opened on May 6, the GovPlus funds had sold some Standard & Poor's 500 index put options on the Chicago Board Options Exchange. When markets plummeted the afternoon of May 6, the funds were on the hook for potentially huge losses. Source

Related to: Flash Crash Lawsuit

Tags: Flash Crash Lawsuit, hedge funds lawsuit, hedge funds flash crash, Citade, NorCap, GovPlus Master Fund LP and GovPlus Fund AI LP