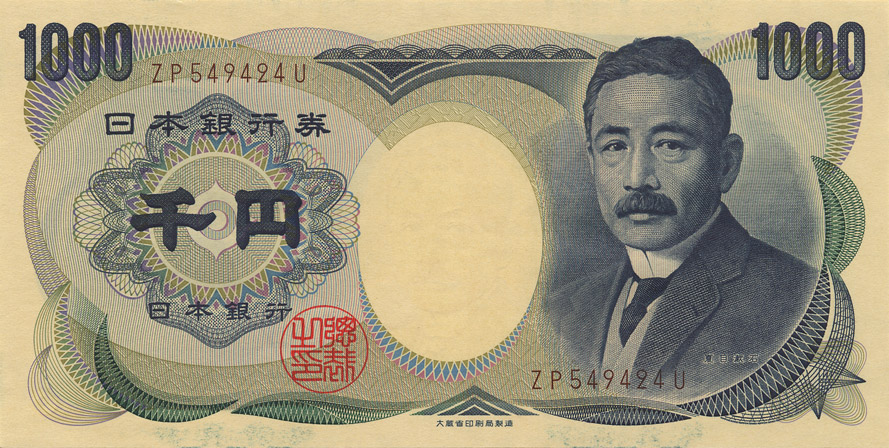

Hedge Funds Yen

Japan Gov't Intervention Costs Hedge Funds Trading Yen

Hedge funds trading in foreign currencies said that the move by the Japanese government to weaken its currency cost them big. John Taylor, head of New York hedge fund FX Concepts, candidly talked about the move by Japan's government and its effect on the fund, "We've lost a whole bunch of money." Many hedge funds had been betting on a stronger yen and, until the government stepped in, had been making a lot of profits doing so.

Other funds that had made money betting on the yen also suffered, including big funds operated by London firms Aspect Capital Ltd. and Winton Capital Management, according to investors. Still, Winton's $5 billion Winton Futures Fund remains up nearly 8% this year, an investor said. Both companies declined to comment.

While the yen's ascent had sparked debate within Japan's government and the investment community over whether Tokyo might intervene, the timing and the size of Wednesday's moved surprised many investors.

Overall, investors held a near-record level of "long" positions on the yen as of Sept. 7, according to Kathy Lien, director of currency research at Global Forex Trading, citing data compiled by the Commodity Futures Trading Commission. They held a net 52,000 contracts on the yen, compared with a sizable bearish position on the yen as recently as May. source

Related to: Hedge Funds Yen

Tags: hedge funds Yen, hedge fund foreign currency, hedge funds trading Yen, hedge funds currency exchange, hedge fund Yen, hedge fund japanese government